China Just Kicked Us in the Shins on Gallium

As Caesar said "Omnia Gallia in tres partes divisa est", which translates to: "Kill all environmental regulations and start mining ASAP"

Introduction

China's recent decision to ban the export of critical minerals, including gallium and germanium, to the United States was a long time coming. The Chinese had been tightening the rare earth metal noose for quite some time, especially those rare earth metals that are used as semiconductor substrates (called III-V materials, after their valence electron structure), which is what we’re going to talk about today. Everyone sort of expected it in the defense electronics industry, at least. Germanium is less of a problem. It’s only 50% in China. Prices will go up, but we shouldn’t panic.

Gallium, however, is a real issue. While there is significant Gallium inside the United States, we haven’t mined it since 1987, Germany not since 2016. China controls upwards of 90% of world Gallium mining. There is significant uncertainty on its downstream impact, especially on defense production. I’ve asked around to some of the players in the industry and have gotten vague answers. The stockpile levels are opaque (purposefully so).

This move is widely viewed as a direct response to U.S. sanctions aimed at curbing China's technological advancements, particularly in the military sector. To be honest, we should recognize that fair’s fair. The Chinese kicked us back in the shins in a spot where we’re vulnerable.

First let’s dig into the “why”. Why are these materials so important? And then we can dig into what I expect the ramifications to be, specifically for Gallium, since Germanium is less of a risk factor.

Who Cares?

You probably think about semiconductors as mostly being on silicon. We make sand think, not rare earth metals! And yet, a minority of chips, maybe 10% of total semiconductor volume, but an important minority, are made of III-V materials. The most common materials are Silicon Germanium (SiGe, which is pronounced like “Siggie”) and Gallium Nitride (GaN), and Gallium Arsenide (GaAs). Now, the problem is that these components are hard to circumvent and perform critical RF functions, due to their unique electromagnetic properties. As a result, the margins on these bad boys are insane. They can cost 10-20x a normal RF chip. You have one in your cell phone and you have one in a ton of medical devices and cell towers. But those are safe. Many are currently fabbed in Taiwan and more civilian chips will end up there due to these sanctions. The real danger we need to understand is on military production, which primarily happens domestically (for the most part).

First of all, China didn’t ban the export of SiGe, GaAs, or GaN. It banned the export of Gallium and Germanium itself (and a few other rare earth materials). These are then used as inputs, combined with Silicon, Arsenide, and Nitride and grown into the crystals that can be used as wafers.

III-V materials are known for their thermal and electric properties. These materials have high electron mobility, allowing electrons to move swiftly, which is crucial for high-speed and high-frequency devices. This means they can handle rapid signal processing (think switching). Their wide bandgap also allows them to operate at higher voltages and temperatures, due to the heat dissipation of their crystal structures. This means they can deal with a ton of power, without starting to literally smoke (thought they sometimes do).

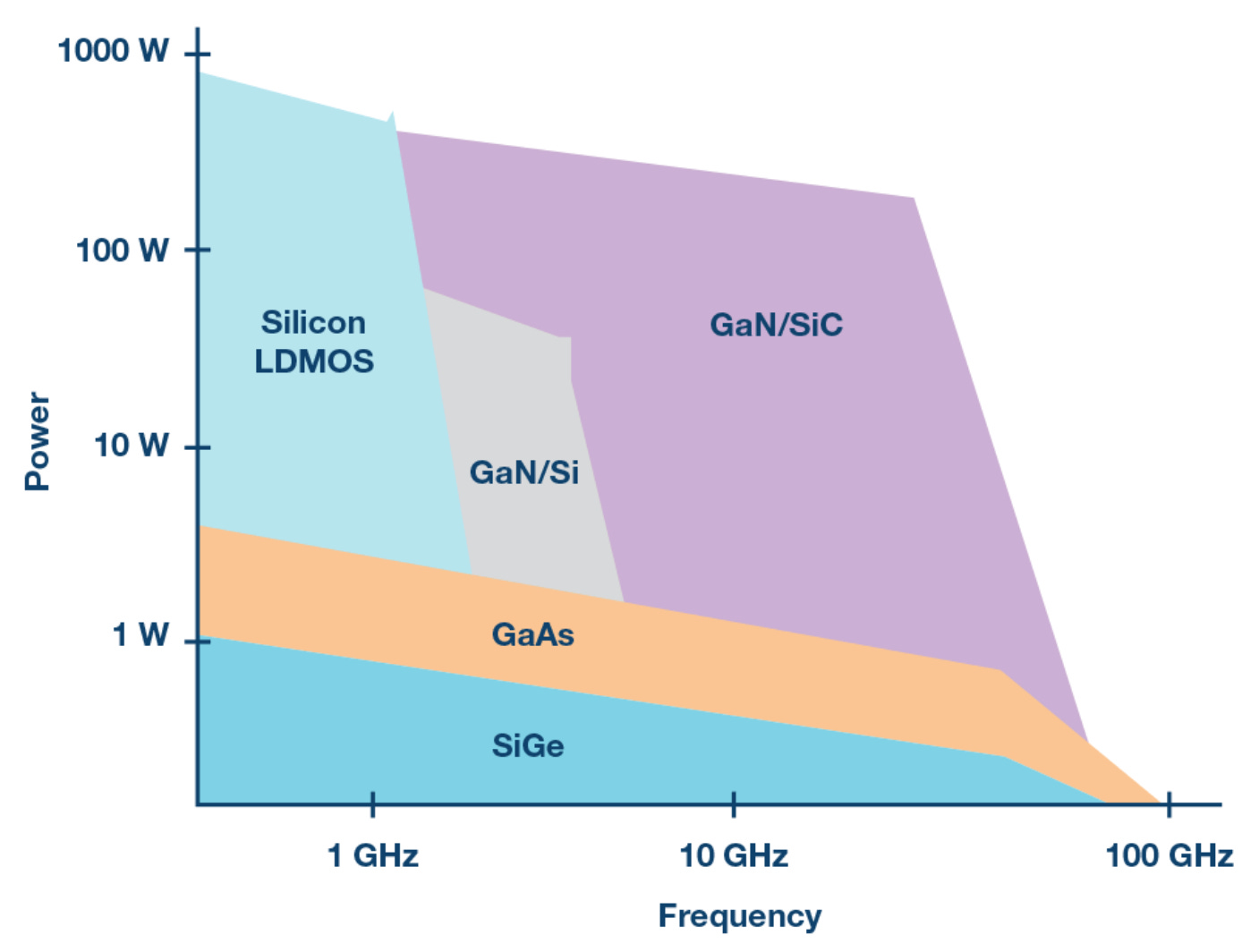

As the chart above makes clear, there are indeed substitute materials. You can design around the shortage, to an extent. For some applications, using a less performant material might work. You might take the chip you wanted to do in GaN and do it in SiGe (Germanium being less of a worry). If you wanted to do something in SiGe and prices went up, you can do it in plain old Silicon. The performance is worse, but it is possible.

And yet, sometimes you can’t escape their use. It’s just not avoidable in military communications, due to their exceptional thermal properties and power handling capabilities. Simply put, if you want to blast a lightbulb, or often when put in an array, hundreds of lightbulbs, worth of RF power into space you’re going to need a GaAs or GaN chip (that’s orders of magnitude more RF power than your cell phone). And unfortunately, many military applications need to do just that power blasting task.

Systems such as advanced radar, electronic warfare equipment, and secure communication devices rely on the superior performance of III-V semiconductors to function effectively. In modern warfare, especially a war against China itself, these sorts of weapons systems are going to be important.

China's Market Dominance: How Did We Screw This Up?

Like many things, the fact that China got such dominance in the III-V chip materials market and the Free-Tradeniks in our policy elite let it happen is beyond me. Let’s chalk it up to incompetence. But it’s a story you’ve heard many many times:

“This whole thing is very environmentally bad. Let’s make it impossible to fulfill regulations to mine it here.”

“Well, cool, we did it…now we have more domestic industry. Let’s buy it abroad.”

“Ah well…the Chinese have poured insane subsidies into putting everyone else but them out of business. Guess we’ll have to trust in the magic of free trade.”

For this section, let’s focus on Gallium. Germanium is another story, and frankly, it’s going to be fine. We mine plenty of it in Alaska and can scale it up.

To be clear, China's grip on gallium production was a purposeful push to dominate an industry that they saw as vulnerable in the West, but very essential. It was strategic and it was smart. The trick was that China already had quite a large Aluminum mining industry, going back to the early days of Communist China, and Gallium was a marginal investment. This is because Gallium is mainly a by-product of aluminum production from bauxite ore. China just had to integrate gallium extraction into this sector. Between 2000 and 2022, China's aluminum output skyrocketed from 4.2 million to 40.2 million tons. Gallium production followed alongside.

As China started to see the first inklings of what would become the trade war between the US and China, back in 2016, China made a play for a dominant position, with foreknowledge of the leverage it provided against US defense production. China used its classic tools of state subsidies and competitive pricing and flooded the market. This aggressive pricing strategy has driven most global producers out of business, leaving China as one of the world's only remaining producers of Gallium and Germanium.

In contrast, the U.S. and Germany just threw their hands up, mostly due to stringent regulations that have hampered domestic gallium production. Environmental concerns and complex permitting processes made it just too challenging to develop new mining operations or expand existing ones. This regulatory environment snuffed out the U.S. gallium industry in the 80s. Germany stopped production in 2016.

Assessing the Damage

As I stated above, the majority of the commercial processes will be fine. Most of them, around 50%, are fabbed at Win Semi, a fab in Taiwan. So commercial III-V Chips really aren’t the issue. It’s defense, which is the point. The problem that we face is while there are workarounds today, if we basically do away with all regulations, we will need a few years to get our own mining operations in place (there’s plenty of Gallium in the United States, for example in Texas and Montana). If we don’t basically zero out compliance, we’re toast.

There’s a few pieces of good news that should lessen our immediate panic. First of all, we do know that there is a strategic stockpile/reserve in the US, somewhere, somehow. People I’ve spoken to at defense fabs seem to be sanguine about the situation. The other piece of good news is that defense volumes are fairly low. Most wafer runs are in the thousands and tens of thousands. We’re not going to run out of these chips tomorrow (though prices will go up). If things get dicey, the United States does also have Gallium and Germanium recycling operations.

The bad news is that we do need someone outside of China, ideally in the US itself, to get up and running eventually, and most mines, thanks to China’s incredibly obvious strategy, are not currently functional for III-V metals. And the road to getting things set up again could be arduous.

The steps in this process are the following:

Resource Assessment and Feasibility Studies (1–2 years).

Permitting and Regulatory Approvals (2–3 years).

Infrastructure Development and Construction (2–4 years).

Commissioning and Ramp-Up (1–2 years).

That’s a grim amount of time. There’s some options in Hungary, Kazakhstan, and Germany and the infrastructure there is more reasonable. They only stopped production in the late 2010s. That might be 1-2 years. For the US, our only option is to basically get rid of any feasibility studies, assessment steps, and regulatory approvals. Zero them out. And then, we get to around 3-4 years.

Conclusion

To summarize: These things are important for defense applications, especially electronic warfare and communications. Perhaps China is cutting us off from them to show force, leverage in future negotiations, or because they rightly want to kneecap us the way we kneecap them. It’s a move that we should respect and should have expected.

Additionally, although we're not going to run out tomorrow, we need to get ready and it’s frankly a little surprising to me that we’re not already moving forward on initiatives to start Gallium mining. Maybe there are and it’s not public, but I am skeptical.

We should take this whole thing as a “learning moment”: Free trade is a national security risk when you’re obtaining a critical component from your adversaries. Overregulation killed an industry, one of many, and we now have to make the right decisions, not just for Gallium, for America’s industrial and mining base as a whole.

What about antimony